Page 60 - Management Digest Udyama Vol 1 Isuue 2

P. 60

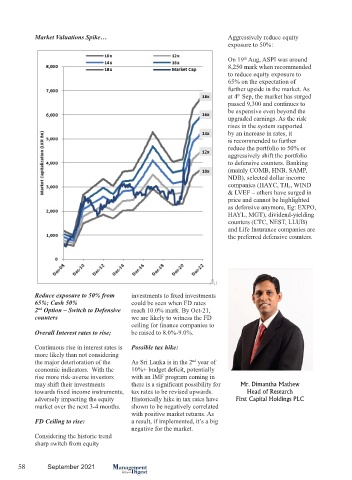

Market Valuations Spike… Aggressively reduce equity

exposure to 50%:

On 19 Aug, ASPI was around

th

8,250 mark when recommended

to reduce equity exposure to

65% on the expectation of

further upside in the market. As

at 4 Sep, the market has surged

th

passed 9,300 and continues to

be expensive even beyond the

upgraded earnings. As the risk

rises in the system supported

by an increase in rates, it

is recommended to further

reduce the portfolio to 50% or

aggressively shift the portfolio

to defensive counters. Banking

(mainly COMB, HNB, SAMP,

NDB), selected dollar income

companies (HAYC, TJL, WIND

& LVEF – others have surged in

price and cannot be highlighted

as defensive anymore, Eg: EXPO,

HAYL, MGT), dividend-yielding

counters (CTC, NEST, LLUB)

and Life Insurance companies are

the preferred defensive counters.

Reduce exposure to 50% from investments to fixed investments

65%; Cash 50% could be seen when FD rates

2 Option – Switch to Defensive reach 10.0% mark. By Oct-21,

nd

counters we are likely to witness the FD

ceiling for finance companies to

Overall Interest rates to rise; be raised to 8.0%-9.0%.

Continuous rise in interest rates is Possible tax hike:

more likely than not considering

the major deterioration of the As Sri Lanka is in the 2 year of

nd

economic indicators. With the 10%+ budget deficit, potentially

rise more risk-averse investors with an IMF program coming in

may shift their investments there is a significant possibility for Mr. Dimantha Mathew

towards fixed income instruments, tax rates to be revised upwards. Head of Research

adversely impacting the equity Historically hike in tax rates have First Capital Holdings PLC

market over the next 3-4 months. shown to be negatively correlated

with positive market returns. As

FD Ceiling to rise: a result, if implemented, it’s a big

negative for the market.

Considering the historic trend

sharp switch from equity

58 September 2021