Page 57 - Management Digest Udyama Vol 1 Isuue 2

P. 57

Higher Borrowing requirement:

Heavy COVID spending and

continued infrastructure spending

is expected to lead to over

10% budget deficit for the 2nd

consecutive year, significantly

increasing Govt’s borrowing

requirement.

Uncertainty over access to

creditors:

Weaker external profile due to a

high share of dollar-denominated

debt exposures has continued

to increase the uncertainty

over access to official creditors Policy rate Outlook maintained:

resulting in inadequate foreign

currency inflows forcing Govt to In our Jan-21 Report we forecasted 2 hikes in 2H2021 (3Q/4Q). In

shift to more short-term higher Aug, Monetary Board hiked rates by 50bps. We maintain our forecast

risk SWAPs. that 1 more rate hike is possible in 2H2021. In 1H2022, the extremely

weak economic indicators may force the Monetary Board to further

Weaker conditions may lead to tighten the monetary policy. Thereby, we expect further 2 rate hikes in

downgrade: 1H2022 as well.

Funding from multilateral/ Yield Curve may rise by another 150-200bps and reach our upper

bilateral partners may not be bands of the yield curve by Jun 2022

sufficient to cover external

financing needs over the next 12

months while Foreign Reserves

are also at a dangerously low level

which are likely to be some of the

key facts that may be seriously

looked at, as it may potentially

lead another rating downgrade.

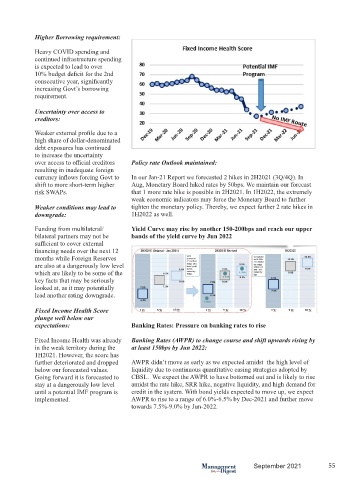

Fixed Income Health Score

plunge well below our

expectations: Banking Rates: Pressure on banking rates to rise

Fixed Income Health was already Banking Rates (AWPR) to change course and shift upwards rising by

in the weak territory during the at least 150bps by Jun 2022:

1H2021. However, the score has

further deteriorated and dropped AWPR didn’t move as early as we expected amidst the high level of

below our forecasted values. liquidity due to continuous quantitative easing strategies adopted by

Going forward it is forecasted to CBSL. We expect the AWPR to have bottomed out and is likely to rise

stay at a dangerously low level amidst the rate hike, SRR hike, negative liquidity, and high demand for

until a potential IMF program is credit in the system. With bond yields expected to move up, we expect

implemented. AWPR to rise to a range of 6.0%-6.5% by Dec-2021 and further move

towards 7.5%-9.0% by Jun-2022.

September 2021 55