Page 65 - UDYAMA FINAL final for web

P. 65

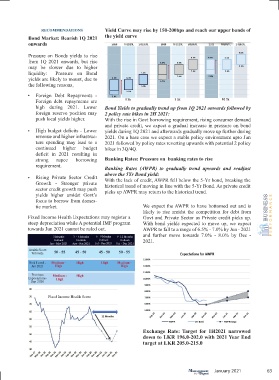

RECOMMENDATIONS Yield Curve may rise by 150-200bps and reach our upper bands of

Bond Market: Bearish 1Q 2021 the yield curve

onwards

Pressure on Bonds yields to rise

from 1Q 2021 onwards, but rise

may be slower due to higher

liquidity: Pressure on Bond

yields are likely to mount, due to

the following reasons,

• Foreign Debt Repayments -

Foreign debt repayments are

high during 2021. Lower Bond Yields to gradually trend up from 1Q 2021 onwards followed by

foreign reserve position may 2 policy rate hikes in 2H 2021:

push local yields higher. With the rise in Govt borrowing requirement, rising consumer demand

and private credit, we expect a gradual increase in pressure on bond

• High budget deficits - Lower yields during 1Q 2021 and afterwards gradually move up further during

revenue and higher infrastruc- 2021. On a base case we expect a stable policy environment upto Jun

ture spending may lead to a 2021 followed by policy rates reverting upwards with potential 2 policy

continued higher budget hikes in 3Q/4Q.

deficit in 2021 resulting in

strong rupee borrowing Banking Rates: Pressure on banking rates to rise

requirement.

Banking Rates (AWPR) to gradually trend upwards and readjust

above the 5Yr Bond yield:

• Rising Private Sector Credit With the lack of credit, AWPR fell below the 5-Yr bond, breaking the

Growth - Stronger private historical trend of moving in line with the 5-Yr Bond. As private credit

sector credit growth may push picks up AWPR may return to the historical trend.

yields higher amidst Govt’s

focus to borrow from domes-

tic market. We expect the AWPR to have bottomed out and is

likely to rise amidst the competition for debt from

Fixed Income Health Expectations may register a Govt and Private Sector as Private credit picks up.

steep depreciation while A potential IMF program With bond yields expected to move up, we expect

towards Jun 2021 cannot be ruled out. AWPR to fall to a range of 6.5% - 7.0% by Jun - 2021

and further move towards 7.0% - 8.0% by Dec -

3 Months 3 - 6 Months 6 - 9 Months 9- 12 Months

Outlook Outlook Outlook Outlook 2021.

Jan - Mar 2021 Apr - Jun 2021 Jul - Sep 2021 Oct - Dec 2021

Health Score

Estimate 50 - 55 45 - 50 45 - 50 50 - 55

Risk Level - Medium - High High Medium -

Jan 2021 High High

Previous Medium - High

Expectations- High

Sep 2020

Fixed Income Health Score

Exchange Rate: Target for 1H2021 narrowed

down to LKR 196.0-202.0 with 2021 Year End

target at LKR 205.0-215.0

January 2021 63